Key Takeaways

- A traditional, defined benefit pension plan provides retired workers with a steady income stream that is guaranteed for life.

- That’s why NEA and its affiliates continue to advocate for defined benefit pensions.

- Unfortunately, powerful, moneyed interests continue to push to replace pensions with 401(k)-style plans that reward educators who stay for just a few years, but give them less incentive to stay.

Special education teacher Danielle Specht admits that retirement was the furthest thing from her mind when she accepted a job in Kodiak, Alaska, 15 years ago. Specht, who was around 30 at the time, had moved from Minnesota with her husband and their infant daughter. When her paychecks started showing up without a Social Security withholding, she initially thought it was an error.

“As somebody who was not really concerned about retirement at that age, I didn’t exactly look into it,” Specht says. Only later did she find out that Alaska teachers are not allowed to participate in the federal program.

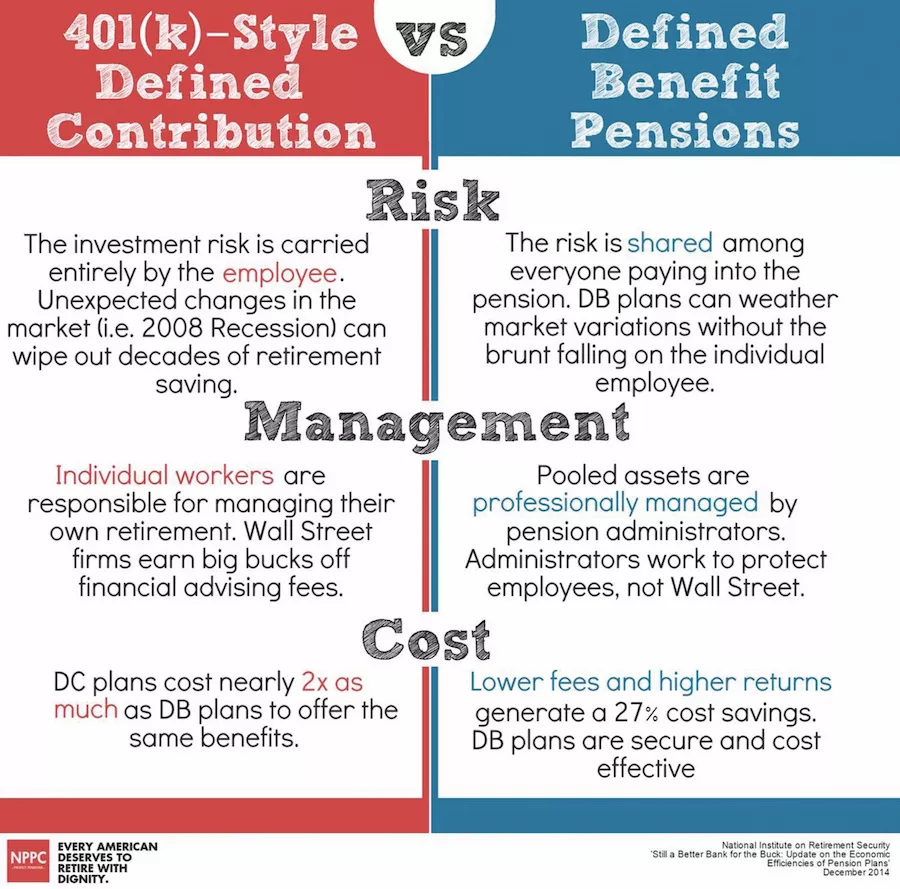

She also did not know that changes to Alaska’s public employee pension system meant she missed out on a defined benefit pension. A traditional, defined benefit pension plan provides retired workers with a steady income stream that is guaranteed for life. This is different from a retirement savings plan such as a 401(k) or 403(b)—called a defined contribution plan—which makes the employee bear all of the risk. The amount of income the retiree will have is not guaranteed and depends upon how much employees contribute and how the plan’s investments perform.

Educators who lack defined benefit pensions often struggle to prepare for retirement.

“Our family has a completely unsecure retirement,” Specht says. “It’s dependent on the stock market. It’s not going to be as big as I need it to be.” Specht doesn’t want to leave Alaska, but now in her mid 40s, she’s taking retirement planning seriously.

She and her husband recently purchased land in Kentucky, where they will move after their teen daughter graduates from high school in another three years. The significantly lower cost of living in Kentucky will allow them to buy a home with land where they can hunt and garden.

“We love Kodiak,” Specht says, “but we can’t afford to stay.”

Specht has long been active her union, educating other members about the value of defined benefit pensions and speaking up to support NEA-Alaska’s fight to reinstate pensions for public employees, including educators.

Educators across the country face equally tough decisions. That’s why NEA and its affiliates continue to advocate for defined benefit pensions.

3 Things You Should Know about Defined Benefit Pensions

1. Good for the employee.

Defined benefit pensions provide educators with a guaranteed, reliable source of income in retirement. Pension plans are comprehensive, providing disability benefits, death benefits, and often cost-of-living adjustments. In other words, they take care of you for life and continue to support your loved ones after you die.

2. Good for the employer.

Pensions are key to attracting and retaining qualified, experienced educators to the profession. Schools and students succeed when talented young people are recruited into the profession and stay in it for the long term.

3. Good for the economy.

Pensions are more efficient than 401(k) plans, providing about twice the value per dollar invested, with higher returns and lower fees. Replacing pensions with 401(k) plans significantly increases fees and the amount the employee has to contribute.

So why are defined benefit pensions under attack?

Unfortunately, pensions have been under attack in recent years. Powerful, moneyed interests continue to push to replace pensions with 401(k)-style plans that reward educators who stay for just a few years, but give them no incentive to stay.

These privatizers’ goal of making teaching a revolving door job is simply misguided. And their claims that teachers would be better served in 401(k) plans simply isn’t credible.

The only sure winners in that scenario are Wall Street firms, who collect higher fees through 401(k)-type plans.

In Alaska

Check out the Action Center to learn more about how NEA-Alaska is fighting for retirement security and get involved.